Disney Earnings Report - Disney+ Subscriber Numbers In The US Are Stagnating

Earlier today Disney released their numbers for Q3/2023, which is Disney’s fiscal Q4/2023, and for the full fiscal year. If you are one of those who hope the Walt Disney Company will crumble and die, I have bad news for you: total revenue for the full year is $88.9 billion, a plus of 7% compared to 2022, and total operating income (before taxes) is $12.86 billion, a plus of 6% compared to 2022.

With that Disney did not quite meet expectations by analysts but still had a pretty solid year, all in all. However if you look at the details there are a few things which are somewhat worrying or at least not as great. And yes, that includes Disney+. Click through for more!

I won’t bore you with a lot of numbers here. Just this: Disney’s Parks & Experiences segment is still by far the biggest money maker for the company, while the Entertainment segment (Streaming, Movies, Linear Networks) generates more revenue overall – a little more than $40 billion for the full fiscal year – it is Parks & Experiences which generates the most profit, $8.9 billion, almost 70% of Disney’s operating income.

Disneyland had higher attendance in the last quarter, Disney’s cruise lines also have increased revenue and profit, whereas the closure of the Star Wars hotel had a negative impact on Walt Disney World’s profit, as well as somewhat lower spending by guests, Disney explains this with lower hotel prices.

But let’s get to the things that matter the most here and are probably of most interest: how is Disney+ doing?

Disney and Hulu combined report a loss of $420 million for the quarter. Which is still a lot but one year ago the loss here was $1.4 billion. Disney are still confident that the streaming business will be profitable by the end of 2024.

Disney does not report the annual loss for just Disney+ (and Hulu), only for their entire direct to consumer business, which also includes ESPN. But here Disney reports a loss of over $2.6 billion for the full fiscal year. Which is still a staggering amount but much less than the over $4 billion reported a year ago.

One reason for the slowly declining losses is an increase in average monthly revenue per subscriber for Disney+. Price hikes show their effect. In North America average revenue is now $7.50, excluding India it is $6.10 outside North America. One year ago the average monthly revenue in North America was $6.10, so Disney increased revenue by $1.40 in the US and Canada. And outside North America (excluding India, where subscribers pay almost nothing for Hotstar) it was $5.83 a year ago, so it’s a moderate increase of $0.27, meaning most of the growth comes from North America.

But what about subscriber numbers? Disney+ added 6.9 million subscribers in total worldwide (excluding India, again, India is its own market, India keeps shedding subscribers, because of the loss of the Cricket, but subscription fees in India are negligible and therefore the Indian market does not really matter all that much). But almost all of that growth comes from outside North America. Here Disney+ turned around things at least somewhat after losing subscribers in the past few quarters and added 500,000 subscribers. Which means outside North America Disney+ gained 6.4 million subscribers (excluding India, where Hotstar lost 2.8 million, but revenue is so low here it barely makes a difference).

In their report Disney does not provide any year over year comparison for subscriber numbers, but of course the old reports are readily available and this is where it gets somewhat troubling for Disney.

Because one year ago Disney+ had 46.4 million subscribers in North America. One year later it’s 46.5 million now. So subscriber numbers remained basically flat, they are stagnating. Revenue growth and reduced losses are mostly a result of higher fees.

Meanwhile Disney+ added 9.6 million subscribers outside the US (excluding India) in the past 12 months. Which is pretty healthy, but much of that was added just in the last quarter.

How does that compare with the competition? When it comes to number of new subscribers Disney can almost keep up with Netflix, Netflix added 8 million new subscribers in the last quarter in total. Disney is not that far off with 6.9 million (if you account for India, where they lost 2.8 million subscribers the total number is just 4.1 million, just half of what Netflix accomplished).

But the really interesting piece of information is how many subscribers Netflix added in North America over the past 12 months: 4 million. While Disney+ added 100,000. Netlix’ crackdown on password sharing was a huge success for the company, so much so that other streaming services like Disney+ do the same thing now. Netflix now has about 77 million subscribers in North America vs 46.5 million on Disney+.

Streaming services are also heavily invested in boosting their subscriber numbers for the ad supported service, because you can increase monthly fees only so much before you will experience a massive push back by customers, in fact, a recent survey found that about 40% of all Netflix subscribers in North America think about cancelling their subscription after recent price increases, either by outright cancelling or by maybe switching to one of the lower tiers, like the ad supported tier. The ad supported tier has one big advantage for streaming services, it opens up the traditional revenue stream provided by advertisers. But with that streaming services may also lose their one big advantage that drove people to them in the first place, an experience uninterrupted by intrusive and annoying ads. But so far Netflix, Disney+ and Co believe customers are willing to accept ads if they pay lower prices in return. But in turn this could turn streaming into cable 2.0. A gamble, in my opinion.

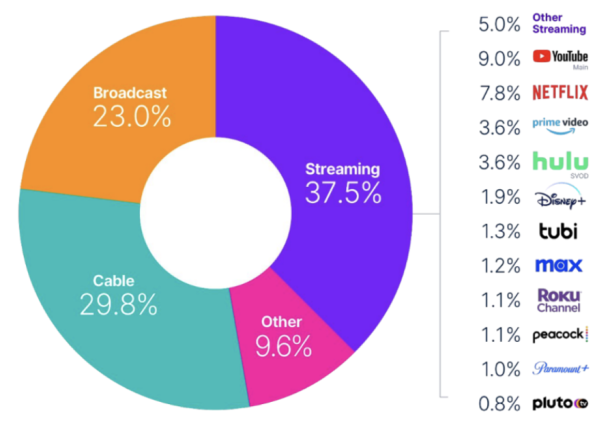

What else: Hulu has about the same number of subscribers in North America as Disney: total number is 48.5 million. And here follows an interesting chart about market share which was included in Netflix’ info letter to shareholders that came with the earnings report:

Here you see a breakdown of the entertainment market in North America. Streaming has the biggest share in 2023. And Disney is in 5th place here with 1.9% market share. Netflix has a whopping 7.8%. Netflix has about 77 million subscribers in North America. Which means Disney+ has about 60% of the customer base of Netflix in North America… yet Netflix has 4x the market share. Even Hulu, which has about the exact same number of subscribers as Disney+, has almost double the market share!

What that means is that the content on Disney+ is simply not doing great. And the weekly Nielsen charts reflect this: you rarely find Disney content on the charts, other than Star Wars, Marvel, Bluey (not even Disney’s IP) and the occasional movie nothing released on Disney+ ever enters the charts. Now you do not necessarily need to have a ton of content on the charts, if you have a broad selection of things people want to watch, Prime Video and Hulu are also rarely found on the charts, only with select content, but both have a much higher overall market share.

So it remains to be seen if Disney+ will ever really be a major player and true competitor of Netflix.

What else: Disney has no separate segment just for its movies, it’s all lumped together in the Content Sales & Licensing segment, but they reported a loss of $149 million here and flat out stated that this is because of Haunted Mansion. Disney’s movie department will not catch a break, because The Marvels will be a colossal flop (box office projections are rarely wrong these days and early reviews are mostly negative as well), and in two weeks from now Wish (the latest animated movie) is projected to be a flop as well, not as massive as The Marvels, but given the production budget Wish could at best break even worldwide, if at all.

So, where does this leave things? Disney will not go bankrupt. Ever. If you are one of those who hope Disney will die… you will wait forever. In the grand scheme of things the movie segment is just not important enough and even Disney+, which is still a money sinkhole, only creates a medium sized dent, because as long as the theme parks and cruise ships work, Disney will swim in money.

Of course the big question is if Disney+ will ever be a success story. We see dwindling ratings for the tentpole shows, i.e. Marvel and Star Wars. And nothing else Disney is exclusively producing for the service ever makes the charts, other than some theatrical movies.

Another concerning fact is that ad revenue on Linear Networks is declining, which is a clear sign that traditional tv is slowly on the way out, most young(er) people watch things on streaming now.

Therefore Disney has a few issues: will Disney+ really be profitable in 12 months from now? Will subscriber growth in North America pick up again or will it remain stagnant? Will Disney’s streaming market share increase? Or will they still play 5th fiddle in a year from now? While Netflix pumps out hit show after hit show. Maybe Disney’s singular focus on Marvel and Star Wars is the biggest weakness, especially when both franchises show signs of weakness and dwindling audiences on Disney+. And they have utterly failed to create anything else that attracts audiences. So Disney should rethink their content strategy.

Still: none of that means Disney is in any serious trouble, yes they could make even more money, but they still make plenty of money. More than $1 billion of profit per month in the last year alone. This is the very opposite of going under.

Related Links

Category: Disney

Previous Article: Pre-Order The Hot Toys Marrok (TMS117) 1/6 Scale Figure

Next Article: Review: Grand Inquisitor - TVC - VC293

![Holographic General Grievous (Toys R Us) - Hasbro - The Clone Wars [blue] (2008) Holographic General Grievous (Toys R Us) - Hasbro - The Clone Wars [blue] (2008)](/theclonewars/thumbs/tcw-ex-grievous1-th.jpg)