Tag Archives: coronavirus

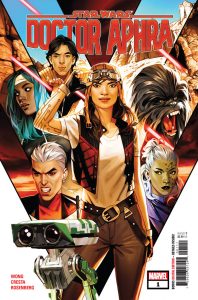

The comic book industry, like so many other industries, is suffering a lot at the moment. A few days ago the largest comics distributor in the US and UK, Diamond Comic, said they will stop distributing comics for the direct market (i.e. comic book shops) for the next few weeks. And with Diamond being the exclusive distributor for Marvel and DC Comics, that means pretty much all the big titles won’t see a print release in the next few weeks. Now the big question is if comics would still be released digitally. And both Starwars.com and Lucasfilm announced that the relaunched Doctor Aphra comic from Marvel would see a release as a digital exclusive on April 1st. But now a source at Marvel told comic news website “newsarama” that the info is inaccurate and that there will be no digital release for Doctor Aphra #1. And apparently that source was correct, Starwars.com changed their preview article and now it says “coming soon”. Digital is only a fraction of the print market and selling the comic as a digital exclusive may not be the best option, especially for a relaunched #1 title. Also, comic book shops will need a lot of hot sellers once they reopen and selling comics as digital exclusives may put even more burden on them. And of course Marvel and DC love relaunches, because #1 releases usually sell a lot more than issues from long running series. And a printed comic would most likely make more money. The main Star Wars title was relaunched a while ago for that reason as well. So delaying the release of Aphra is probably the best option for both Marvel and comic book shops. But as a result of this comic book fans waiting for new Star Wars issues probably need to have a lot of patience in the next few weeks.

It seems our worst fears, a lack of Star Wars toys, will not come true. In fact, things look quite good for Hasbro! Hasbro’s stock price rose more than 12% today, after Brian Goldner said in a statement to CNBC that Hasbro is seeing an increased demand in toys and that supply chains in China are up and running again. Hasbro may miss a few shipments, but they are catching up and Goldner expects that by April they will be fully caught up again. It seems that people staying at home are buying more board games than before, Goldner mentioned Monopoly, Operation and Play-Doh as some of the toys that see increased demand. So even if many of us may have to stay at home a while longer, we will most likely not have to live without new Star Wars toys!

Brian Goldner, Hasbro CEO

Several European governments have asked Disney to reduce the video quality for Disney+. The service will launch tomorrow in several major European countries, however, because of the ongoing coronavirus pandemic, several governments are afraid that above average usage of streaming services by people told to stay at home may congest the internet. Even though German internet providers reassured that there’s more than enough capacity, at least in Germany, Disney complied and the service will reduce the bitrate in Europe for the next few weeks. Furthermore, France asked Disney to postpone the launch of the streaming service. So now Disney+ will launch two weeks later in France.

Disney is not the only company to reduce the video bitrate in Europe, YouTube, Amazon Prime and Netflix also reduce bitrates. So you may get somewhat less than optimal video quality in Europe for the time being. Maybe some European countries need to upgrade their internet infrastructure. According to reports Switzerland is even considering to disable video streaming services in the country until further notice. At least that is not an option in the other European countries. If you watch videos on various streaming platforms in Europe you may see some artifacts here and there. It’s not you then, it’s the streaming service!

Covid-19, better known as the coronavirus, has the world firmly in its grip. And the Walt Disney Corporation is no exception here. Like all other entertainment companies Disney is facing stiff challenges, challenges that may, to a certain degree, also affect Star Wars. Movie releases get postponed, most theaters in the US are closed anyway, worldwide most countries have shut down all movie theaters, tv and streaming series productions are on hold, theme parks are closed, Disney cruises are shut down at least for another two weeks. But chances are the crisis won’t be over in two weeks and that whatever counter measures are in effect now will still be in effect in April and maybe even May and June. First analysts theorize that now may be the perfect time for Apple to buy Disney, Disney’s stock price is falling and it will most likely continue to fall. So what exactly is going on right now and what does it mean for us, the consumers? Click through for more details!

The ongoing coronavirus crisis has now reached the Disneyland Resort in Anaheim, California. Today it was announced that the park will close its gates on March 14th and that it will not reopen for the remainder of the month. The hotels will be open until March 16th (Monday) to allow guests to plan for their departure. It is unknown if Disneyland Anaheim will actually reopen in April or not. Walt Disney World in Orlando, Florida remains open for the time being. Nevertheless the coronavirus will certainly hit Disney’s theme parks division very hard and 2020 may turn out to be a horrible year for the company. Because not only theme parks are affected, but movies as well. Pixar’s latest movie “Onward” had the worst opening of a Pixar movie ever. Other studios postpone the release of their movies. Perhaps Marvel Studios will be affected too. Black Widow will be released in late April / early May, but if things have not improved by then its release may be postponed as well. Bob Chapek certainly has his hands full now managing the crisis. Let’s hope Disneyland will actually reopen in April and that things will improve. However, in all likelihood, the epidemic will get worse, we have not reached its peak yet according to several experts. Stay safe!

UPDATE: Disney World in Orlando and Disneyland Paris in France will also shut down now!

![Darth Vader - Hasbro - The Power of the Force [FlashBack/CommTech] (1998) Darth Vader - Hasbro - The Power of the Force [FlashBack/CommTech] (1998)](/star-wars-power-of-the-force-starburst/thumbs/potf2-starburst-flashback-darth-vader1-th.jpg)