How Much Money Does Hasbro Still Make With Star Wars?

Hasbro usually doesn’t report their Star Wars revenue to the public anymore, all they do is give us some very general statements about how Star Wars sales decline or grow. But I believe I may have found a method that allows us to accurately estimate Hasbro’s Star Wars revenue in recent years, especially for the years 2016-2018. In this article I will not only give you an estimate about how much money Hasbro still makes with Star Wars, I will also show you how interest in Star Wars toys has been developing over time. So if you want to know how Star Wars is doing for Hasbro, click through!

This article includes several charts, I encourage you to look at them because they will illustrate how interest in Star Wars toys is developing. In short: it’s declining. Rapidly. I will also provide a very short summary at the end of the article, if you absolutely hate charts and dislike reading some text that explains what you see. At least check out the first chart following further below, it’s the one chart that is the basis of everything here in this article!

As you certainly remember, I examined the popularity of Star Wars as a whole and various Star Wars characters in the past week, using Google Trends. This is when I got the idea that maybe Google Trends might be a tool that could help me estimate Hasbro’s Star Wars revenue.

While Hasbro hasn’t been reporting their Star Wars revenue since 2006, there are official Hasbro numbers for 2005 and 2006, the last time Hasbro provided us with numbers for Star Wars and most importantly, there are numbers by market analysts for the years 2010-2014, plus an estimate for 2015 which can be corroborated with a statement by Brian Goldner, that in 2015, for the Force Awakens, Hasbro saw smililar revenue for Star Wars as in 2005 for Revenge of the Sith.

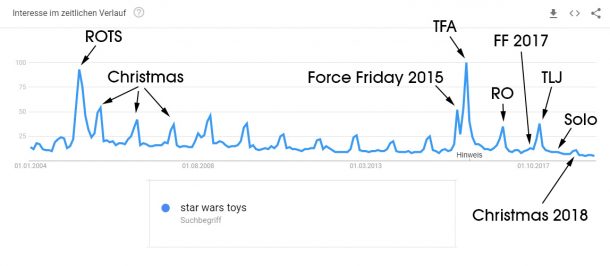

First, I tried to think of a generic search term that might tell us how interest in Star Wars toys has been developing over the years. I tried a very simple approach “Star Wars Toys”, a very generic search term, certainly, but maybe used by people who look for gifts or want to know what’s new.

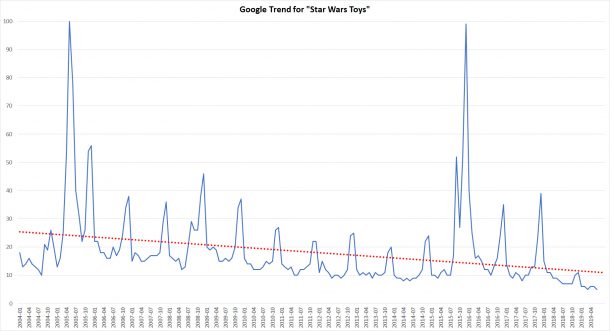

But let’s look at what the Google Trend for “Star Wars Toys” shows:

Google goes back to 2004. So the past 15 1/2 years are covered. And when I saw what results “Star Wars Toys” yielded, I was actually positively surprised and encouraged that it might be a very useful trend.

As you can see the Google Trend for “Star Wars Toys” shows us several real life events. Not only can you see when movies were released, you can also tell when Christmas was and even Force Friday is visible in the data. On top of that the smaller bumps between each Christmas overlap with San Diego Comic Con.

This gives me enough confidence to say that the trend for “Star Wars Toys” may be used to guess Star Wars revenue. But before we go there I want to show you a few other interesting things.

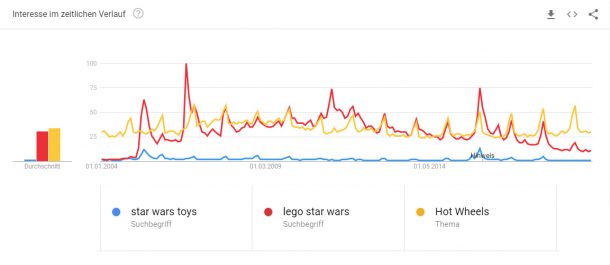

I also compared the trend for “Star Wars Toys” with other toy trends. To gain some perspective! First up I want to show you how “Star Wars Toys” compare to “Lego Star Wars” and Mattel’s “Hot Wheels” toy cars:

Now, “Lego Star Wars” and “Hot Wheels” are both much more specific than the very generic “Star Wars Toys” and chances are that “Star Wars Toys”, while representative of the overall interest in Star Wars toys, does not really show the total interest in Star Wars. That being said we can see an interesting trend here. Interest in “Lego Star Wars” is declining. However, with “Hot Wheels” you can see how a brand can sustain a more or less constant trend on Google over the years. The peaks usually represent Christmas here, the toy business is very seasonal, so that is no surprise. Lego however, also has some huge peaks between Christmas, I didn’t look further into it, but maybe that coincides with the release of new sets.

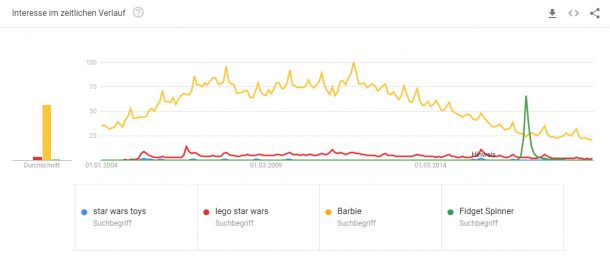

And then I took a next step and compared “Star Wars Toys” and “Lego Star Wars” to a global juggernaut: “Barbie”. And to see what happened I also added “Fidget Spinner”. You certainly remember the fad from a few years ago.

Barbie eclipses almost everything. But you can see how interest has been declining over the years. This decline in interest coincides with a decrease in Barbie revenue for Mattel. And you can also see what a true toy fad looks like. The green peak is the Fidget Spinner craze. It came out of nowhere, exploded fast, only to shrink back to nothing a few months later. All of this shows that Google Trends certainly reflect real life revenue trends for toy brands.

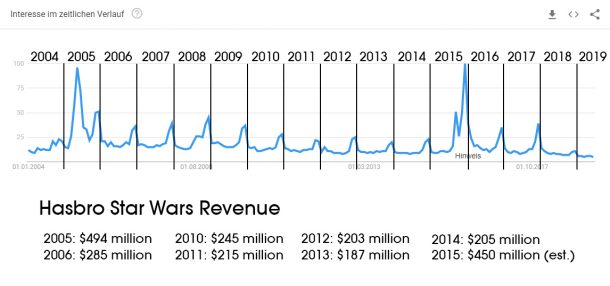

After these few charts let’s return to Star Wars toys. First, up, let me show you the trend for Star Wars toys and the revenue numbers that we know:

The 2015 estimate is based on numbers released in Forbes and a statement by Brian Goldner that 2015 saw very similar revenues compared to 2005. Even a cursory glance here will tell you that yes, revenue seems to correlate with the trend for Star Wars toys on Google.

Google Trends allows you to export all data into Excel. Which I did to work with the raw numbers Google provides, that is, a value for the interest with a range from 0-100. These numbers are relative, so when, say, the Star Wars trend for June 2012 was “10”, it means in June 2012 “Star Wars Toys” only trended 1/10th of what it did back in 2005 when Revenge of the Sith was released.

Let me show you the Excel version of the “Star Wars Toys” Google Trend:

I also inserted the trend line for “Star Wars Toys” (the red dotted line), it’s a linear regression of all the values and the trend line is a great tool to show you how interest has been developing over the years.

As you can see “Star Wars Toys” is trending downwards, in other words, interest is declining.

What you can also see here that there are several phases. First there is the ROTS peak, after that interest in Star Wars toys was more or less stable for 2006 and 2007. Interest increased again in 2008 when The Clone Wars premiered in the USA. But interest once more steadily declined until summer 2011. From summer 2011 until summer 2015 interest stagnated or declined ever so slightly. Then in late 2015 the craze for Star Wars toys starts again, only to decline again very quickly.

And finally, there is the visible decline in interest after The Last Jedi (the last very high peak to the right). Solo hardly makes a bump anymore and Christmas 2018 saw the least interest in “Star Wars Toys” on Google ever since Google has recorded data.

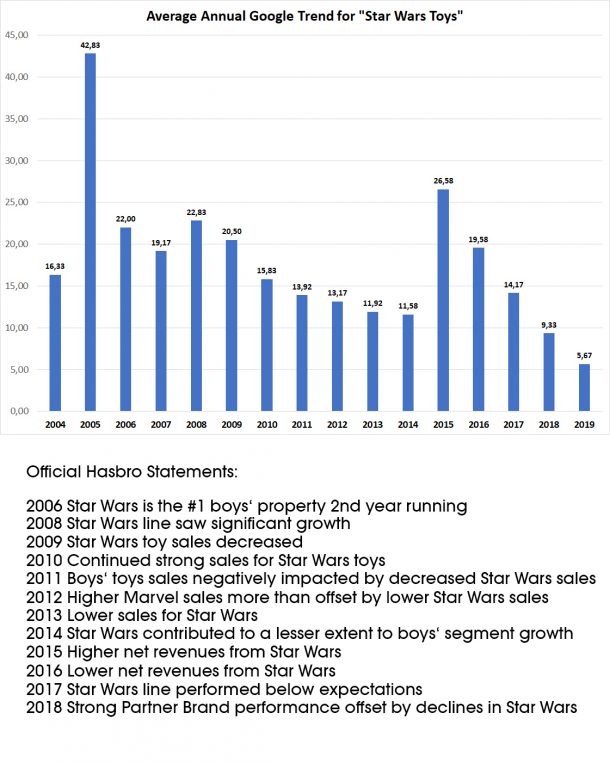

What I did next is to calculate the annual average trend for each year. I simply added up trend data for all months in a year and then divided by 12. Maybe a somewhat crude method, but let’s see what we get:

I added official statements from Hasbro / Brian Goldner, either from the annual reports or Q&As following the annual reports. You can see that the statements by Hasbro more or less agree perfectly with the annual trend number I calculated! Only the statement for 2010 does not really show in the data, maybe Hasbro was bending the truth a little bit back then. Of course what constitutes “strong sales” is always up for debate.

You can also much better see how annual interest in “Star Wars Toys” developed over time. You see that while 2015 had this very high peak in December, overall interest averaged over 12 months was only about 60% of the interest back in 2005 when Revenge of the Sith was released.

Interest only rapidly spiked with Force Friday in 2015. Back in 2005 the peak was much broader at the base, meaning Star Wars was trending for a longer period of time. There was a relative lull in the summer, only to gain more momentum the closer we got to Christmas.

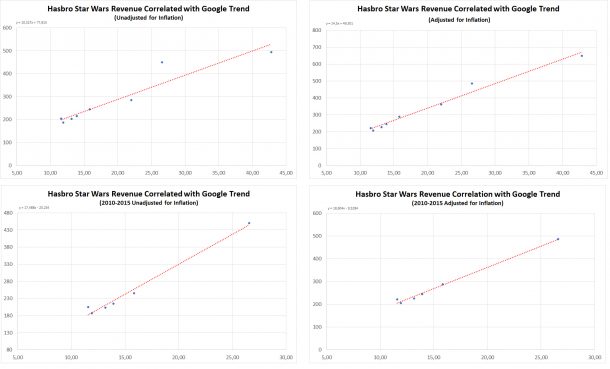

Now it’s time to estimate Star Wars revenue for Hasbro. To do that I did the following: I performed a linear regression for the annual “Star Wars Toys” Google Trend and Hasbro’s Revenue. We have data for 8 years. So it’s certainly worth a try and we can see whether or not we get useful results.

Now, the maths shall not concern you, in short, the linear regression tries to find a formula for a straight line that best fits your data. The result is a formula which you then can use to calculate values for which you have no data. I differentiated four cases, to see which case gives a best fit. First, I included all revenue data, including data for 2005 and 2006. For the second case I adjusted all revenue for inflation (in 2019 USD). Then I merely looked at the revenue data for 2010-2015, since this is the only period for which we have contiguous data. And last, I adjusted the 2010-2015 revenue for inflation to see what this will get us.

Here are the four scatter plots, don’t worry, you don’t need to concern yourself too much with them. But enlarging the graphic will give you a visual cue about how well the linear regression fits the actual data. The red trend line is the linear regression, the dots are the actual data.

I also calculated “r” and “R², which is the correlation coefficient (Pearson) and coefficient of determination. The first number tells you how good the correlation actually is. 0 means there is no correlation at all. 1 means there is a perfect positive correlation, – 1 would be a perfect negative correlation (the higher x gets, the lower y will be). The second number, R², tells you how well the trendline actually fits the data, how much of the variance of the revenue can be predicted by the variance of the Google Trend average, the closer to +1 or -1 R² is, the better the Google Trend variance predicts revenue variance (i.e when the one changes, so does the other).

Method 4 (bottom right), which uses data from 2010-2015 and adjusts for inflation, yields the best results. But all the methods are really, really great.

Correlation ranges from 0.944 (first method, 2005+2006, 2010-2015; unadjusted for inflation) to virtually perfect 0.996 for the fourth method (2010-2015, adjusted for inflation). R² ranges from 0.891 to 0.992, which is excellent as well.

Using the formulas derived from the linear regression I then went on and calculated the interpolated Hasbro Star Wars revenue for 2016-2018. I used all four formulas to see which range we get. The numbers you’ll see have been un-adjusted for inflation, i.e. the revenue I got with method 4 has been adjusted back to its original dollar value in 2016, 2017 and 2018.

Hasbro Star Wars revenue for 2016: $284 million – $333 million

Hasbro Star Wars revenue for 2017: $227 million – $243 million

Hasbro Star Wars revenue for 2018: $143 million – $176 million

To put things in perspective: lowest Star Wars revenue for Hasbro since 2004 was in 2013 when they made $187 million (unadjusted) or $201.5 million adjusted to 2018 USD.

In other words: in 2018, despite much higher prices for Star Wars toys and added inflation, Hasbro most likely reported their lowest ever Star Wars revenue since at least 2004. And this with support from a Star Wars movie.

What is especially troubling is that in 2018, without support of a movie in the holiday period, there was only a very weak spike in interest around Christmas. This aligns with Hasbro’s Q4 statements which saw weak holiday sales for Star Wars.

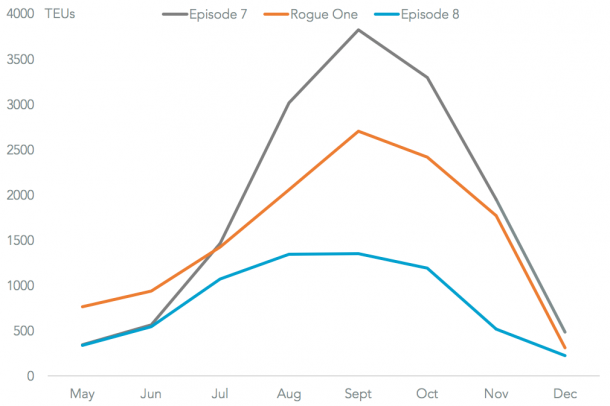

And finally, I want to show you this data from market analysts Panjiva, it is a chart for how much Star Wars merchandise retailers orderd to ship in 2015, 2016 and 2017:

You can see how the data for shipments also aligns perfectly with my interpolated revenue. Hasbro too said, that Star Wars toy sales for The Last Jedi didn’t meet expectations.

This gives me some confidence to say that my, even if somewhat crude perhaps, method of finding a correlation between a Google Trend for “Star Wars Toys” and Hasbro’s Star Wars revenue works.

The correlation between the Google Trend and revenue undeniably exists, it’s almost 1, so virtually perfect.

So then, quo vadis, Star Wars toys?

The data tells us that interest is declining, and declining rapidly. 2018 might have been the worst Star Wars year in a long, long time for Hasbro. What we only guessed based on Hasbro’s quarterly reports can now be expressed in actual numbers.

And Star Wars revenue for The Last Jedi was a lot lower than for Rogue One, anything between only 63%-72% of what RO made, and The Last Jedi was a major saga movie and did also make more money at the box office. But the movie failed to convince people to buy the toys as much.

I believe both Disney and Hasbro have a tough job ahead of them. They must invigorate interest in Star Wars toys. The collector base is apparently shrinking and the people who still collect Star Wars should absolutely be listened to.

It remains to be seen if The Rise of Skywalker can breathe new life into the brand. So far, interest in 2019 (based on the Google Trend for “Star Wars Toys”, which has been shown to correlate almost perfectly with revenue and official statements by Hasbro!) is at an alltime low, at least since data has been recorded.

Whatever momentum Hasbro and Disney had with The Force Awakens quickly eroded again. To the point where Star Wars toys are a sad sight at many retailers, with online maybe slowly replacing retailers, but it seems this is not enough to counter the very negative trend of declining sales.

The data now perhaps explains why so many Star Wars toy aisles give a sorry sight in 2019 and why so much Star Wars merchandise ends up at Dollar Stores, Ollie’s or Ross. Simple lack of sales and interest. And this coming from a temporary high in 2015, when Disney and Hasbro had the chance to breathe new life into Star Wars toys. The data shows this didn’t work at all and interest has since collapsed, along with revenue.

Summary:

- Hasbro Star Wars revenue for 2016 was about $333 million, in 2017 it was about $243 million and in 2018 it was about $161 million; +- $20 million or so.

- Star Wars revenue in 2018 is the lowest at least since 2004, even unadjusted for inflation.

- Interest in Star Wars toys is declining steadily, it has reached its lowest point yet in early 2019, interest noticably declined after release of The Last Jedi and has been declining since.

- 2018 saw the first holiday period since 2004 with no significant boost in “Star Wars Toys” interest, this Google data aligns with official statements by Hasbro. Between 2005 and 2014 Star Wars Toys always saw a significant boost around Christmas, even without support of a movie. This is no longer true for 2018.

So, what are your thoughts here? Do you think my method of estimating the Hasbro Star Wars revenue is sound? Does it concern you that interest seems to be rapidly declining, along with revenue? Do you have hope that The Rise of Skywalker may turn the ship around again? Early Google Trends for The Rise of Skywalker however tell us that the movie might underperform. Disney certainly needs to rethink their overall approach to everything here. In light of this it will be interesting to see what becomes of the master Star Wars toy license, up for renewal in late 2020.

Related Links

-Click HERE to return to the home page-