Hasbro's Dismal Earnings Report For Q4/2023, Mattel The New #1

Earlier today Hasbro released their numbers for Q4/2023 and also for the full year. And as expected the results are pretty bad. Click through for the details!

While CEO Chris Cocks is super optimistic about the future of Hasbro (at least in the earnings call), the here and now is less than rosy for Hasbro.

Revenue for the full year is down by 15%, 5.00 billion vs $5.86 billion in 2022.

Q4/2023 revenue declined 23% compared to Q4/2022, $1.289 billion vs $1.678 billion the year before.

Hasbro reports a massive unadjusted operating loss of $1.539 billion, most of it is attributed to impairment charges, Hasbro sold its eOne business in the fourth quarter. Because of that Hasbro lost more than $1 billion in the fourth quarter alone.

Wizards of the Coast and the digital gaming segment remain strong, The “Lord of the Rings” expansion for Magic: The Gathering was the bestselling set of all time according to Hasbro, and licensing payments from Larian studios for the massively successful Baldur’s Gate 3 video game as well as the mobile Monopoly Go! game boosted the digital gaming segment.

Chris Cocks was also quite happy with the reintroduction of Furby.

But other than that things look really bad. Consumer product sales declined 25% in Q4/2023 year on year.

And if we look a bit closer to the one thing that interests us the most here, Partner Brands, they had a very weak performance, sales are down by 44% in Q4 yoy and 35% for the full year. Total Partner Brands revenue in 2023 was just $687.8 million vs. $1,052 million in 2022, which was already a bad year.

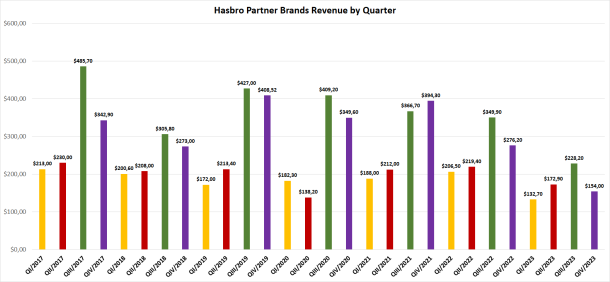

The Q4 numbers for Hasbro’s Partner Brands are the weakest in a long time. Here is a chart that goes back to 2017 that shows you the quarterly numbers for the Partner Brands:

Q4/2022 was already a very weak quarter, and it is when Hasbro’s current woes began in earnest. A look at the previous years reveals how weak Partner Brands performed in 2024. Some of the decline can be attributed to exited licenses, in their Q3 earnings call Hasbro said about 50% can be attributed to discontinued or exited licenses. You also have to remember that those numbers are unadjusted for inflation and do not reflect higher prices and are not in constant currency, i.e. actual unit sales must be disastrous given the very high retail prices in 2023.

Nothing was said about Star Wars. It was briefly mentioned in the earnings call where the new $7.99 4 inch action figure line was brought up as a new Star Wars toyline. Nothing else was said about Star Wars, but a quick look at the numbers suggest that sales for Star Wars must be down as well, given the huge 44% Partner Brands decline in Q4/2023 and 35% for the full year. Chris Cocks gives “entertainment” as one reason for the decline, he seemingly forgets that Star Wars at least had The Mandalorian and Ahsoka in 2023 and The Mandalorian used to be a massive boost for the sales. Apparently not anymore.

That being said, Hasbro clings to the top spot in the action figure segment. Hasbro has a market share of 23.4% in the action figure segment, which is up by 0.5 points even.

But that is weak consolation when you look at Hasbro’s main US competitor, Mattel. Hasbro is no longer the #1 American toy company, Mattel’s revenue is significantly higher than Hasbro’s in 2023: $5.441 billion for Mattel vs $5.00 billion for Hasbro. And while Hasbro reports massive losses (unadjusted), Mattel posts an unadjusted operating income of $562 million for the full year. LEGO is still the king of the hill of course, but not really comparable to either Hasbro and Mattel with their much more diverse product line-up.

Hasbro used to dominate Mattel in the past years and frequently outperformed Mattel, but now Mattel has taken over from Hasbro again and Hasbro’s outlook for 2024 is not rosy, they expect consumer products revenue to further decline an additional 7-12% in 2024 and even Wizards of the Coast is expected to see a decline, mostly because Baldur’s Gate 3 boosted revenue in 2023, but no comparable game will be released in 2024.

So under Chris Cocks Hasbro now plays second fiddle to Mattel, a company they outperformed ever since 2017, the last time Mattel made more money than Hasbro was in 2016. In 2021 Hasbro made almost $1 billion more than Mattel, now Mattel makes almost half a billion more than Hasbro.

One has to wonder if that is indeed “excellent”. Maybe it’s time for Chris Cocks to go. Also, one cannot deny the disastrous impact Disney’s woeful performance at the box office and with many of their Disney+ shows (especially Marvel!) had on Hasbro’s very weak Partner Brands numbers. Their Q4/2023 numbers are the weakest in a long, long, time. And Disney is still Hasbro’s most important partner when it comes to licensed toylines. One has to wonder if their partnership will have a future, considering the massive revenue decline. As things are now licensed toy brands are becoming more and more of an afterthought for Hasbro and contribute very little, a mere 13.8% of Hasbro’s total revenue came from Partner Brands in 2023. And just 12% in Q4/2023. Back in 2021, Partner Brands still contributed 18.10% to Hasbro’s total revenue. And in 2022 it was still 17.96%. Partner Brands become less and less important for Hasbro. But maybe that is what Chris Cocks means by his motto “Fewer, Bigger, Better!”… Well, for now only the “fewer” part of the motto is an accurate description of the company. They are certainly neither bigger nor better. And let’s not forget that Hasbro laid off almost 1/3 of the total workforce in 2023. Maybe it’s time to lay off the management.

Hasbro’s Eearnings Call

Hasbro’s Earnings Call Presentation (PDF)

Hasbro Earnings Call Transcript on Motley Fool

Mattel’s Earnings Call (PDF)

Related Links

Category: Hasbro, Toy Industry News

Previous Article: Last Chance To Order The Sabine Wren & Chopper (C1-10P) Mural Set

Next Article: Visual Guide Update - Riot Scout Trooper - The Black Series

-Click HERE to return to the home page-

![Maz Kanata - Hasbro - Star Wars [Solo] (2018) Maz Kanata - Hasbro - Star Wars [Solo] (2018)](/star-wars-solo/thumbs/solo-basic-maz-kanata1-th.jpg)

![ARF Trooper - TCW [SOTDS] - Basic (CW18) ARF Trooper - TCW [SOTDS] - Basic (CW18)](/galleries/2016/Review_ARFTrooperSOTDSTCW/thumbnails/Review_ARFTrooperSOTDSTCW010.jpg)