Hasbro Financial Results Q1/2024

Wall Street is celebrating Hasbro’s latest earnings report. The company posted an operating profit of $116.2 million. The stock price is up by almost 12% as I write this. And then you look at the report and you wonder what on earth these people are partying over. And Star Wars? Not worth a mention at all. You want to know why Hasbro no longer talks about Star Wars? Click through for more!

Hasbro CEO Chris Cocks at the earnings presentation (symbol photo)

Now Wall Street only looks at profits and dividends and Chris Cocks is full of praise of his “Operational Excellence” (aka we fired thousands of people) that sees the company back on track. And sure, an operating profit of $116.2 million is a huge improvement over the year prior.

But then you look at the report in detail and you wonder… this is what Wall Street is partying over?

Overall revenue is down another 24%. Even if you adjust for the sale of eOne and the revenue decline attributed to the sale, revenue is still down 9%. The Consumer Products segment (aka “toys” and “games” the things a toy company is usually known for) is down 21%, and this segment reports a loss of almost $47 million for the quarter. Hasbro says “broader industry trends” are to blame.

In fact, almost the only thing keeping Hasbro afloat is once again the massive Magic The Gathering / Dungeons & Dragons business, this segment also has an operating margin of 38.8%. What any company dreams of. Which means it is basically the only profitable business Hasbro currently has. Printing overpriced trading cards costs little money after all. Should for any reason the trading card business ever collapse (no sign of that yet) Hasbro would be in deep trouble though.

And Star Wars?

Like last time Hasbro didn’t mention Star Wars even once. Marvel wasn’t mentioned either btw.

The reason?

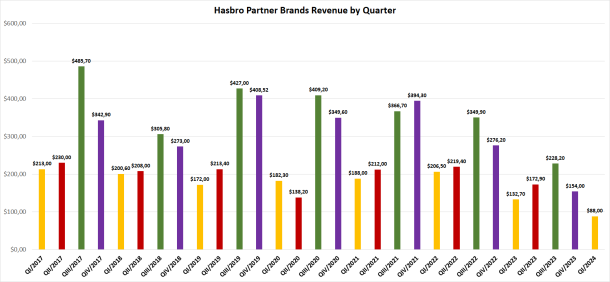

The partner brands segment is down by another 34% after an already really bad last year and Q1/2023. It’s now just $88 milion vs $133 million in Q1/2023. In fact, the reported $88 million is the lowest result for the licensed partner brands segment since basically forever. Or at least ever since Hasbro restructured their business and got rid of the boys toys segment and introduced franchise, partner and portfolio brands. Numbers from before the restructuring are not comparable.

This of course means sales for Star Wars (Marvel etc) action figures must be circling the drain. Now consider the insane 2024 prices and what that means for actual unit sales.

However, Hasbro is still the action figure segment leader with 20% market share, a decline of 1.2 points. But that of course includes brands Hasbro owns or at least doesn’t have to pay royalties for, like Transformers.

The consumer products segment (toys, games) is much more rapidly declining in Europe, -34% compared to a 14% decline in the US. Maybe people do have all the Monopoly versions they would ever need after all.

Anyway, Chris Cocks is optimistic to reach his goal of a companywide adjusted operating profit margin of 20% by 2027. In fact, this would be extremely easy to achieve… just get rid of those pesky toys and games business altogether and become the Magic The Gathering company, you’ll have lovely margins of almost 40%.

Hasbro expecets that the Consumer Products segment will be down for the full year. Wall Street does not seem to care. Because Hasbro paid $97 million in dividends to shareholders in the last quarter. I wonder what the fired Hasbro employees think about that. Let’s hope they are happy their loss of a job made some rich people even richer. What a great “Operational Excellence” indeed.

Hasbro earnings report

Hasbro earnings presentation (PDF)

Hasbro earnings call transcript via The Motley Fool

Related Links

Category: Hasbro

Previous Article: Pre-Order Commander Cody (Chrome Edition) & 0-0-0 (Triple Zero)

Next Article: Free Shipping At Disney Store Through Tonight

-Click HERE to return to the home page-