Funko Will Lay Off 10% Of Its Workforce And Destroy $30+ Million Worth Of Excess Inventory

Before you immediately skip this article because Funko does not interest you: you want to read this. Because Funko’s brand new earnings report for 2022 potentially tells us a LOT about Hasbro and Star Wars. And how Hasbro may try to dazzle and misdirect people with lots of smoke, mirrors and glitter when they talk about “record sales” for Marvel and “sales growth” for Star Wars. You certainly remember Hasbro’s proud announcement about these things? Well, Funko’s earnings report sheds some light on what “record sales” and “sales growth” can actually mean…

We don’t talk about Funko all that much here, because Funko Pops apparently appeal to a different demographic and not the middle-aged somewhat grumpy collector who got his or her first Star Wars action figure in 1978. However, Funko’s recently released 2022 results shed some very interesting light on the collectible market and the challenges they are facing. In fact, it may (and certainly does) even provide some context for Hasbro’s earnings report from a while ago. Because what is happening over at Funko is almost certainly also happening at Hasbro.

And the headline gives you a good indication of what is currently going on at Funko. It’s nothing good. And they had record sales even, their sales in 2022 are up by 29%, yet that all means very little… Click through for the full story!

Let’s imagine this…

Your net sales for 2022 increased by a whopping 29% and even in the very difficult holiday period, something that affected ALL US based toy companies, sales merely declined 1%, you might think that things must be wonderful when sales are now almost $1.3 billion for the entire year. A new record high! You never made as much money as in 2022! Pop the champagne?

But then you also have to report an operating loss of $5.2 million for the full year, and an astounding $46.7 million loss in Q4 alone, Q4 basically ruined your entire year, your net income margin decreased -699 points to now -0.4% for the full year. And your inventory (i.e. unsold toys stored in a warehouse) increased by a whopping 48%.

This is the story of Funko in 2022. Now Funko has some unique challenges, apparently a new warehouse they set up is creating all kinds of issues for them, they can’t run it efficiently because a software rollout is coming later than planned, but apart from that Funko is facing the same issues as so many other toy companies: increased production costs and retailers who cancel orders. Resulting in greatly reduced margins and excess inventory they can’t get rid of.

And contrary to Hasbro Funko is much more open about the challenges they are facing.

- Funko’s direct to consumer business is booming (think of their version of Hasbro Pulse) and grew 37% in 2022, 15% of Funko’s business is now direct to consumers, however there have been chargebacks (i.e. cancellation of orders) by retailers en masse

- Funko’s inventory at the end of 2022 was worth $246 million, an increase of 48% compared to the year before, that is $246 million of yet unsold toys stored in warehouses and containers, the inventory situation coupled with the problems at the distribution center is so bad that the rent for containers Funko needs to store the excess inventory in had a major impact on their net earnings, in comparison Hasbro’s inventory at the end of 2022 was up by 22.5% to now $676 million worth of toys, it is unknown if Hasbro also has to resort to renting shipping containers because their warehouses are overflowing

- the inventory situation is so bad that Funko will now even destroy $30-$36 million worth of inventory, i.e. the toys will be trashed, burned, put in a landfill, in short, these are things that no one wants to buy anymore, it is cheaper for Funko to write off these toys than to keep storing them somewhere. All the plastic and therefore precious non-renewable resources will be wasted. Destroying the toys is apparently even cheaper then dumping it on Ollie’s doorsteps

Now I want to remind you that Hasbro also had to admit that retailers still have lots of inventory and here it’s reasonable to assume that Hasbro is affected as much as Funko or Mattel or any other toy company, or maybe even worse given their disastrous Q4 numbers: retailers ordered more than they needed in fear of shipping issues, resulting in excess inventory on their end. And while some of Funko’s inventory woes are apparently explained by distribution center issues, Funko openly admits that retailer chargebacks are also responsible for their excess inventory.

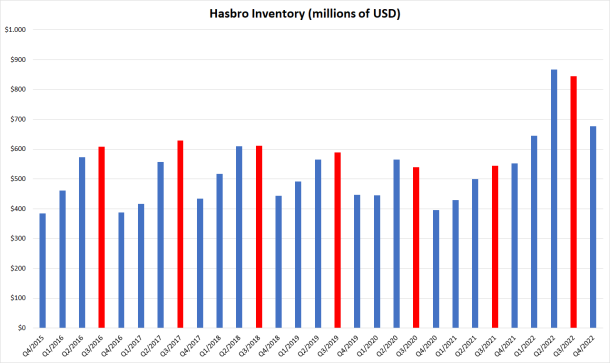

Actually, if you look at Hasbro’s earnings report their inventory situation is also somewhat precarious: they had close to $845 million of excess inventory in Q3/2022, a plus of 55% compared to the previous year and an absolutely record high for the company. The situation has somewhat improved in Q4, inventory is still a very high $676.8 million, an increase of more than 22% compared to the year before. And buried in their report Hasbro also cites increased warehousing costs for one of the reasons for the bad Q4 results.

In short: retailers simply don’t need any new toys, they still have plenty of them in their own warehouses, so they don’t order anything new and even cancel what they previously ordered, leaving Funko (and almost certainly Hasbro) with unsold excess inventory. Part of which they will now destroy. Also buried in the small print Hasbro reports “write-offs” of more than $13 million of inventory in Q4 2022. This does not necessarily mean there is no demand by consumers, you have to remember that retailers are the actual customers of companies such as Funko and Hasbro, and if retailers overstock dramatically for whatever reason, they may still sell lots of toys, but don’t need to order anything new, which in turn results in bad numbers for Q4 for basically all toy companies in the US.

However, in the case of Funko they do more openly admit that storage costs and production costs are simply too high and that even record sales cannot offset it. Which certainly explains why Hasbro already raised prices by up to 30% in 2022.

When we look at Hasbro they reported record sales for Marvel and sales growth for Star Wars. Now you have to wonder if the story at Hasbro is similar to what is going on at Funko. They massively increased inventories strongly suggests this. Because on paper Funko also has “record sales”, their sales increased a whopping 29% for the full year even! So demand exists. They also say retailer sell through is good. Funko’s revenue has never been higher before! Yet they are in dire straits at the moment. Unsold inventory is at a record high. To the point they have to literally destroy inventory they cannot sell, because retailers ordered way too much from them before.

It is very, very likely that Hasbro too has been heavily affected by retailer chargebacks (cancellation of orders), their massively increased inventory levels hints at that. In an earlier article today I talked about the lack of ANY product release or even reveals for The Mandalorian season 3. Well, you can’t really reveal or release anything if retailers simply don’t order anything from you or only very little.

Here I need to remind you that Hasbro’s 4th quarter was a disaster, much, much worse then Funko’s 4th quarter or even Mattel’s 4th quarter. Hasbro had the worst 4th quarter of any US based toy company, relatively speaking. Their partner brands revenue (Marvel, Star Wars etc) was down -30% in Q4! Inventory levels are up by 22%, which is already an improvement compared to Q3/2022 when inventory levels were close to $900 million, or a whopping +55% compared to the year before. Which suggesrs retailers must have cancelled orders en masse.

Here is a look at Hasbro’s inventory levels in the past few years:

I color coded Q3, since Q3 is usually the quarter when Hasbro reports the highest inventory levels. Which makes sense, since they are storing wares for the upcoming holiday season, yet to be shipped to retailers. Inventory levels are usually the lowest in Q4 (Hasbro’s quarterly earnings are usually the highest in Q3 because of the holiday rush). Now look at the inventory levels for 2022, they are all on a record high, indicating that what affected Funko (retailer chargebacks) also affects Hasbro.

And sure, Hasbro was proud to announce a “record year” for Marvel and “sales growth” for Star Wars, but if you look at Funko’s earnings report you have to wonder how much money (profit) Hasbro actually made with both properties, because Funko actually returned a loss. You can absolutely report record sales, and still have a horrible quarter or even year. So the whole “record sales” and “sales growth” spin can be very, very misleading if you fail to mention how much profit you actually made.

And yes, Star Wars was in the top 10 best selling IPs throughout the year for Funko, as was Marvel, Mandalorian toys even were the best selling IP in Q1 2022, and Star Wars was the best selling IP in Q2 2022, it remained in the top 3 for the rest of the year. So chances are that Funko too could say they had record sales for Marvel and sales growth for Star Wars… just like Hasbro… yet Funko returned a loss overall. Of course it is possible that of all the brands Star Wars (and Marvel) actually returned a profit and that only all the other IPs returned a loss, but I find that highly unlikely. It’s reasonable to assume that the lousy margins and retailer chargebacks affect all IPs. Especially considering the fact how expensive Disney’s license is which further affects margins for both licenses. Thus both Star Wars and Marvel are especially affected by higher production costs and retailer rebates or chargebacks and already low margins are probably really bad now, to the point a company like Funko may even make a loss with each figure sold, and indeed, they lost money with each figure sold, their margin is -0.4%. And you have to remember that Funko has to pay licensing fees for basically everything, they have no GI Joe, Power Rangers, Transformers or My Little Pony, IPs they actually own. So Funko’s situation may very well apply to Hasbro’s partner brands segment (i.e. all the licensed toys) as well.

So what will Funko do? First, Funko, just like Hasbro, has a new CEO now, it’s actually the company founder who has returned. They also have a new CFO. There was a personnel shake-up at the company after troublesome Q3 numbers.

And they are playing by the book, they are a publicly traded company after all. They will reduce costs, try to get more money from retailers, increase prices and fire 10% of their workforce to become profitable again. Basically, the same things Hasbro is doing. If even a small company (compared to Hasbro) with a much smaller overhead is not able to return a profit with collectibles like Star Wars or Marvel Pops (plus a myriad of other licenses)… you have to wonder how a toy giant like Hasbro with an enormous overhead is faring in the profit department when it comes to licensed toys. Funko only has licensed toys (when it comes to Pops which account for the large majority of sales) and their margins are no longer existing.

Now the big question is if consumers will pay more and more money for inessential things no one really needs. Or if those retailer chargebacks are just a sign of things to come. A BMO analyst said about Q4 that both Marvel and Star Wars look “tired”, and the same analyst was spot on in his predictions for Hasbro’s woeful Q4 numbers.

At the end of the day one has to wonder how bad things really are for Hasbro’s Star Wars (and Marvel) team, despite “record sales” and “sales growth”. How does that compute when you also consider the -30% partner brands revenue in Q4? Hasbro says it is partly explained by abandoning some licences. But is that the full story? Because Funko shows us how you can have record sales (and even a much less disastrous Q4 than Hasbro when it comes to net sales, their sales only decreased 1%)… and still return a loss and have lots of unsold toys you need to destroy. And at least independent analysts believe that Star Wars and Marvel toys are “tired”, so fewer and fewer people bought them in Q4. And there is no hope of reversing that trend if you don’t have any new product on shelves (or online) for the ONE hit show Lucasfilm and Disney have on Disney+ and retailers try to sell their own excess inventory they ordered ages ago for things that are no longer relevant.

Maybe next time an investor should ask Hasbro about the actual profit they make with Star Wars these days and maybe follow up with how high unit sales are, sales growth can mean very little as we learn from Funko. My guess is Hasbro will decline a reply. Probably for good reasons. So the question remains how healthy Star Wars merchandising is in 2023 and if between increased production costs, Disney’s licensing fees, high inflation for everything and thus greatly increased consumer prices things are about to collapse badly. The next earnings report will shed some light on these questions. Things will certainly be interesting in 2023!

Funko Earnings Report

Funko Earnings Presentation (PDF)

Funko Earnings Call Transcript at Seeking Alpha

Related Links

Category: Funko, Hasbro, Toy Industry News

Previous Article: Is Modern Star Wars Collecting Broken Beyond Repair?

Next Article: Pre-Order The Denuo Novo Bo-Katan Kryze Helmet

-Click HERE to return to the home page-

![Tatooine Stormtrooper - Hasbro - The Power of the Force [Red] (1996) Tatooine Stormtrooper - Hasbro - The Power of the Force [Red] (1996)](/star-wars-power-of-the-force-red/thumbs/potf2-red-basic-figures-tatooine-stormtrooper1-th.jpg)

![Boba Fett (Electronic) - POTF2 [FF/TKC] - Action Collection (Exclusive) Boba Fett (Electronic) - POTF2 [FF/TKC] - Action Collection (Exclusive)](https://www.jeditemplearchives.com/galleries/2019/Review_BobaFettElectronicACPOTF2GFF/thumbnails/Review_BobaFettElectronicACPOTF2GFF001.jpg)